WIDE WORLD OF TRADE REPORT ARCHIVED SPECIAL: EARTHSBLOOD

Summary

dredging oil.

leaders v laggards.

II WEEK 515.

global growth.

Today many global economies are or will be facing a standard deviation in inflation. This is due to the rising stability in the earthsblood markets that is looking ahead at a hard seventy dollars a barrel. CEO LORD IBO RICHARDS of CORNER OIL INTERNATIONAL wich a member of the IZ CORP EXCHANGE in good standings gave us his divine insight on the subject. LORD IBO RICHARDS made it clear that the rise in energy will steepen the yield curve by itself and will stifle most smaller less advanced economies who in turn will seek shelter or protection in the form of assistance from the neighboring larger more advanced economies. This is nothing new but now the energy will be more of a crisis, take for example the US economy, the largest economy with a larger portion of the economy on some sort of assistance from government. This means that rise in energy will draw down those that are just making the grade causing the government to restructure its order of finance from taxes to education. Infrastructure is good sign for rising energy cost for it is uplifting. At the end of the day CORNER OIL INTERNATIONAL sees over one hundred a barrel for earthsblood in the near term. For some odd reason new to the growth of the emerging markets earthsblood is getting more and more valuable on the planet despite the global economies going cheap green and energy efficient. CORNER OIL INTERNATIONAL specializes in energy research and refines oil into motor oil not only is the price of research going to get more expensive but we see the the price of the motor oil doubling within seven to ten years not a bad investment if I do say so myself.

WIDE WORLD OF TRADE REPORT

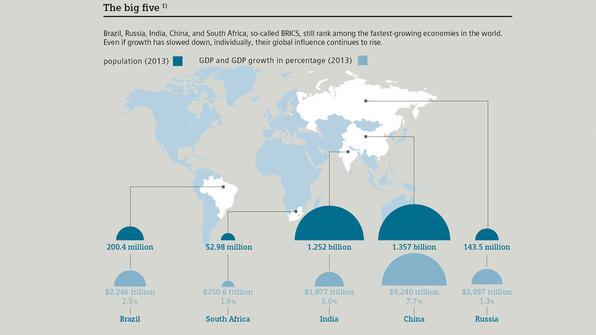

observe BRIC nation with South Africa by GDP growth five years to compare

Currently COI is allowing investors to view our planned models however the vetting system for allowing entry will be quite selective. Why? The price of this market has shown great stability in the long term with the speculation and growth. Outside investments we see the earthsblood non seasonal. Furthermore the reality of economics on the planet is concerning. When an economy cannot be competitive or even maintain in the goods or commodity spaces then the human being in that given economy will flee from those areas causing more strain on those economies losing persons.

THE WIDE WORLD OF TRADE REPORT

Observe the past year for the earthsblood

"Currently earthsblood spreads are quite attractive relatively cheap, not a bargain, just not as much intrinsic values than before the last one hundred dollar push. In any event the short term will yield decent for us and the process of the the expansion of the largest economies will continue".

Mention not that many financiers and techies see themselves in their industries as the catalyst driving stocks back to new levels. COI doesn't disagree but proves the point from a true economic developmental perspective meaning that investments are the future energy especially in the form of the earthsblood has been the driving force in the economic recovery not just of the US economy but the entire emerging markets scene. Companies like NE, NCR. CHK, and ESV count themselves out as needing help in stock value however twenty five to forty dollars on the barrel could push them up three percent or better. Thank you and have a great day.

WIDE WORLD OF TRADE REPORT

WIDE WORLD OF TRADE REPORT

LORD IBO RICHARDS DIVINE SITE ANALYSIS

WIDE WORLD OF TRADE REPORT

LEADERS V LAGGARDS

Follow the leader the Eurozone established austerity while the U.S. Economy stimulated. Now Eurozone is doing stimulus the rates are going up. Investors see a bottom out in bonds investors also noticed the US has not yet raise rates interest rates and the new economy is not going to be normal this is good for bonds. Governments around the world have no choice but to recognize the emerging of global economies, example, when China proves negative economic data the markets in the US economy falter. The same in Europe the size of their economies matters the headache is the different types of societies different governments do have different ideas free capitalist societies entertain more of a solid foundation than others. In the grand scheme of emerging markets regulation is necessary for the world to grow as the US financial reform which is based on regulation eventually stabilizes. The retooling of the US economy which attracts investors and establish trust is necessary for growth in the new age of technology through emerging markets. Thank you and have a great day.

WIDE WORLD OF TRADE REPORT

II WEEK 515

US markets are rebounding. Investors are proud of China's economic data due to be revised. The headache in the near term is Greece. The Greek economy is a laggard verses the more mature US Economy yet there is concern that the lack of cash equals the lack of buying power which would cause the use of credit which could become exhausted in a new global competitive market. In a crunch if credit liquidity becomes an issue and the reality of being back to the beginning of the stimulating after austerity will cause global markets to retreat as they investors wait for the Eurozone to catch itself.

THING4KING

- Oils | Oil Warmers

- Oils | Oil Warmers

Search by Price

The China economy and the U.S. Economy are in competition for better inventories and sales.

THE WIDE WORLD OF TRADE REPORT

Global Growth

There is a growing concern on the rate of global growth. One issue that affects the rate of global growth is fixed assets as real estate outside the US in places like Africa are not experiencing propert appreciation. Long term assets as seen in the US can be used as a nest egg and or converted to cash as the value goes up. A negative is that the value of the property isn't used to increase the net worth of individuals who live in the homes. In places like Utah and Atlanta million dollar homes are increasing. This is a plus for neighboring communities as the opportunity for those homes could rise. Many argue that there could be a bubble in housing as homes prices shoot up. This is good for a US economy who is under the fear that interest hikes will cripple investments that have given many Americans leverage in business and most importantly retirement.

A positive is the amount of jobs being created in the US that have been steady over the past year. Moving forward with global growth the US being the leader in investments there is a concern of the amount of money owed verses the amount of monies being spent. The new implemented health care is said to take the largest economy out of debt in so many years.

One would argue that as quiet as its kept with the constant talk of rate hikes is the amount of money in the credit default swap markets as many investor concerns is that the global markets could topple or face serious headwinds despite the advancement in earnings growth and dividend payouts and also capital expenditures that are influencing investments.

The fact that there is a war coming along in the middle east that now has larger economies involved for the concern that investments could be stagnant if fairness isn't a primary objective. There are trust issues.

Uncertainty in emerging markets is creating opportunities for many new investors as volatility increases however overall this isn't a positive.

There is the issue of pollution which many will also argue is raising concern. The drastic drop in metal prices is abnormality. The question what does this mean to investors.

Global investment research is looking like the new normal. This is relatively important due to constant stream of new and improved technology.

The US economy questioned the "wealth gap" which is disturbing as the opportunities continue to present itself to Americans.Many would argue that the wealth gap is overrated. In the US compared to many economies in strife and neglect have nothing at all. One successful investor is being quoted as what is poor or less fortunate in the US economy? Two flat screen TVs and a cell phone? Cost push inflation. It will be very interesting over the next few years on how emerging markets and smaller economies deal with this as they see the rising cost of food.

LORD IBO RICHARDS

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment