WIDE WORLD OF TRADE REPORT: US ECONOMY SAFE HAVEN FOR INVESTMENT

Summary

UNCERTAINTY.

ANTICIPATION.

VOLATILITY.

UNCERTAINTY

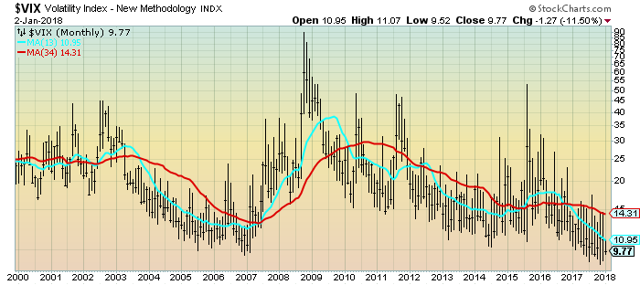

Many in the market argue that "bonds are a safe haven" to flee into as stock markets go down. The scenario plays out as if instead of getting out of the market when it goes down buys bonds and stay in. Ok just buy bonds. perhaps another way to short the market and prove brilliance. Are you asking or telling? The liquidity trap is justified. Uncertainty looks for the market to continue to surge forward. As investors look for the Loch Ness monster of the economic markets. Natural output is unrealistic being that regulation demands for actions that create opportunities within the broad economy. See when prices go down or even become very volatile money increases. In fact a "level of natural output could have been established now that the US dollar is showing some positive signs. However the shock whenever it is coming from usually federal policy entails a decrease in spending something that the new administration in the US is all in for though the tax reform could cause business and consumers to spend more dollars and not hoard more cash it's to early to significantly make a call on what "will" actually happen. The lower interest rate is no more this has already happened and is most definitely factored in most current yield curve models and inflation mandates." The VIX measures volatility. Yet many, from observing market behavior see the VIX being used to challenge the measure of inflation as this VIX shows.

The yield curve the true negotiator of target inflation is being put aside for the simpler easier user friendly indicator that can be traded. From a economist perspective his is quite convenient. The new normal suggest the yield curve offsets price levels when the economy returns to normal. That depends on what's normal. The economy is strengthening and expanding that's for sure how fast and how much more it can grow unharmed in this current economic environment is another story. When the money is constant and again many will argue that when interest rates are back to normal the job numbers will push to its natural unemployment rate causing inflation to drop. This could be very upsetting for the U.S economy who is in lew of finding the correct money growth formula that benefits the masses of the economy. Keep in mind the major economic indicator that still drive the market is the weekly job numbers that show only those working. This is a charitable argument in many economic circles.

The yield curve the true negotiator of target inflation is being put aside for the simpler easier user friendly indicator that can be traded. From a economist perspective his is quite convenient. The new normal suggest the yield curve offsets price levels when the economy returns to normal. That depends on what's normal. The economy is strengthening and expanding that's for sure how fast and how much more it can grow unharmed in this current economic environment is another story. When the money is constant and again many will argue that when interest rates are back to normal the job numbers will push to its natural unemployment rate causing inflation to drop. This could be very upsetting for the U.S economy who is in lew of finding the correct money growth formula that benefits the masses of the economy. Keep in mind the major economic indicator that still drive the market is the weekly job numbers that show only those working. This is a charitable argument in many economic circles.

ANTICIPATION

The U.S. Economy is seeing dismal growth in 2018. This is discomforting news for investors who light of seeing major Government interventions in the form of spending and reform to stabilize the economy are fearing the beginning of an out in major sectors of the overall economy. For instance artificial intelligence is drowning out major sectors in the US stock market. Here take your pick ADBE one of my favorites and NVDA and AMZN to name a few are literally blowing the old way of living out the water. The quality of life begs to differ as less fortunate in the economy are driven into the two step of despair the technology which again in many economic circles is argued to be a new era

Despite the very attractive earning numbers which lead to higher corporate profits which make the stock market go up the government has relaxed itself and overspent in the form of welfare aid through health care which is now being undone so less fortunate families is a concern in the broad based economy. The rich get richer is the saying, meanwhile the housing market has risen to what many argue as record highs as investors fear liquidity will be become an issue. Many regions that have seen the price action in housing re calibrate as house flipping cash buyers drive the market to new highs leaving not much affordability for financial investors. This is causing a major concern for the U.S. Economy in which many communities thrive off the home using it as the nest egg as a financier.

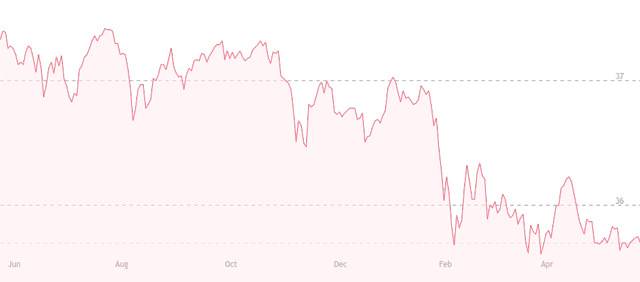

The GDP growth is a let down as the forecast doesn't look any better. This in light of the largest transfer of wealth in the US Economy that was established through traditional investment puts the slow and steady U.S Economy far ahead of its emerging competitors who again look to the safest place to invest and its bond market. This is an interactive chart of JNK for the last year.

VOLATILITY

The U.S economy has proven itself a winner as the safest place to invest. With the 30 year treasury note over 3 basis points who's complaining? In 2017 there were 277 public auctions in which securities were sold to finance U.S debt to the tune of almost 9 trillion dollars. This is just public auctions these numbers do not constitute institutional auction. Back to bonds or buy the broad stock market? Buy the stock market and sell bonds? This is volatility in a handbag in the U.S economy. Good thing for emerging markets. Thank you and have a great day.

Disclosure: I am/we are long DIA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

THING4KINGS

http://www.thing4king.com/product.asp?pfid=29312&dispcat=0

Clever beam-style trim, welcome sign, and thatched roof bless this birdhouse with fairy-tale charm!

Weight 2.4 lbs. 9 3/4" x 9" x 12 1/2" high. Wood.

Weight 2.4 lbs. 9 3/4" x 9" x 12 1/2" high. Wood.

Additional disclosure: The information in this article was brought to you by QBKR ASSOCIATION and researched by MAXE RESEARCH whom are both members of the IZ CORP EXCHANGE in good standing